- NVIDIA’s stock is under close observation due to recent fluctuations, with potential recovery tied to its role in AI technology.

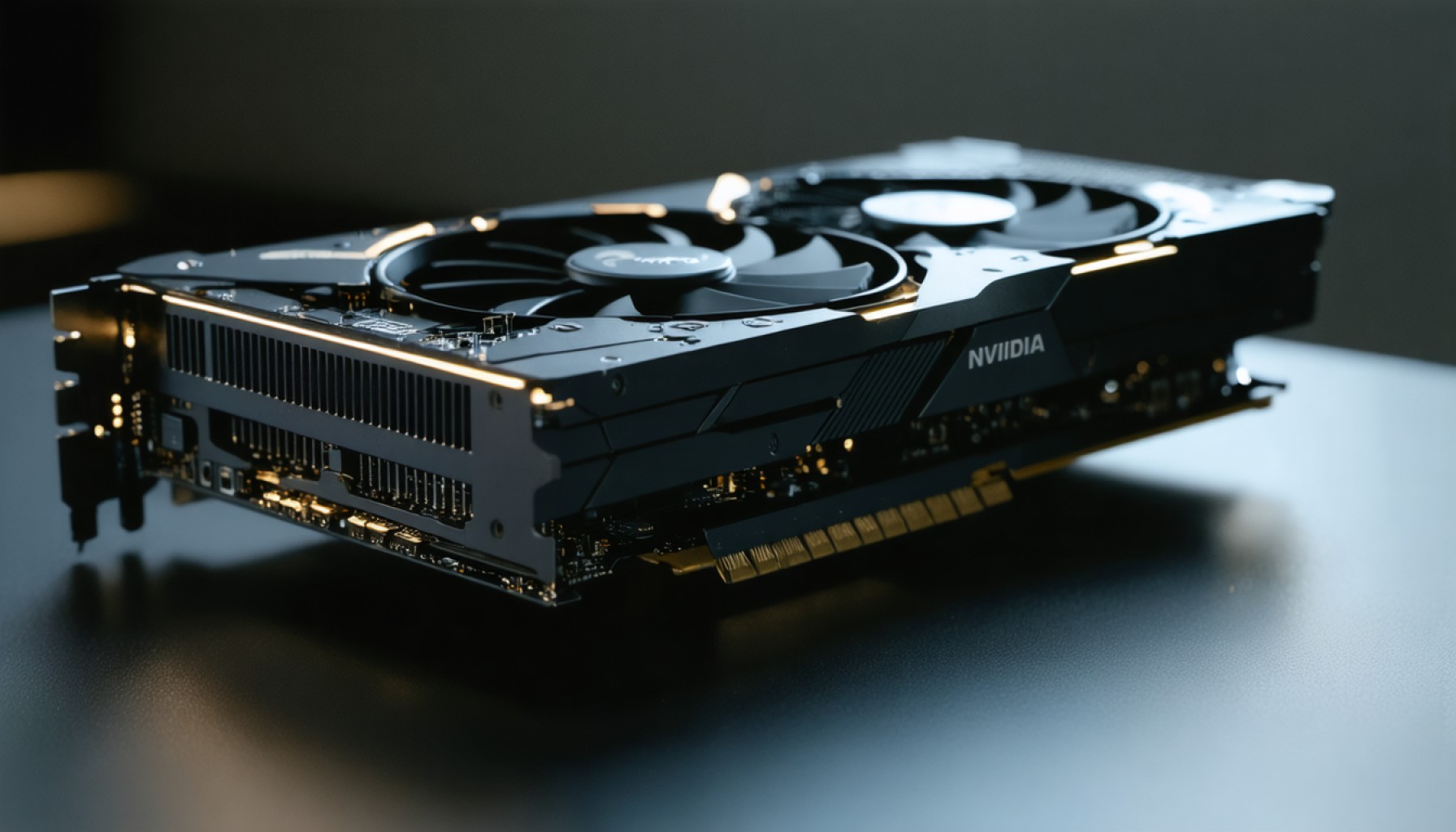

- Renowned for its GPU technology, NVIDIA is pivotal in powering AI applications and has a dominant presence in deep learning and AI computations.

- The rise of AI-driven sectors like autonomous vehicles and smart cities presents growth opportunities for NVIDIA through strategic collaborations with major automakers.

- NVIDIA’s ventures into AI software, like CUDA and AI development kits, showcase its efforts to diversify and strengthen its market position.

- Potential challenges include supply chain disruptions and regulatory changes, although strong R&D and strategic expansions fuel optimism among analysts.

- Investors should monitor AI developments and NVIDIA’s strategic initiatives for possible significant stock performance improvement.

In recent months, investors have been closely watching NVIDIA’s stock, speculating whether it will rebound from the recent dips. What factors are at play? The answer may lie in NVIDIA’s strategic positioning within the rapidly evolving artificial intelligence (AI) landscape.

NVIDIA has long been a leader in GPU technology, critical for powering AI applications. Over the past decade, the company has carved out a dominant role in deep learning and AI computations. As AI technology continues to grow at an exponential rate, NVIDIA’s expertise and product offerings could be pivotal in defining the sector’s future.

One promising horizon is the rise of AI-driven industries, such as autonomous vehicles and smart cities. NVIDIA’s ability to leverage its GPUs for AI workloads positions it as a key player. Its collaborations with major automobile manufacturers to incorporate ultra-efficient AI chips in cars could drive substantial growth.

Furthermore, NVIDIA’s recent ventures into AI software—from frameworks like CUDA to AI development kits—reflect its determination to diversify and adapt to future demands. This holistic approach, combining both hardware and software solutions, enhances NVIDIA’s competitive edge.

However, challenges remain. Supply chain disruptions and potential regulatory changes pose risks that cannot be ignored. Still, with its robust R&D investments and strategic expansions, many analysts are optimistic.

In essence, while volatility is inherent in any tech stock, if AI technologies take center stage, NVIDIA’s stock may not only recover but also reach unprecedented heights. Investors are advised to keep a keen eye on both AI advancements and NVIDIA’s strategic moves.

NVIDIA’s Future Unveiled: Why Investors Should Be Paying Attention Right Now

What New Innovations Are Driving NVIDIA’s Growth?

NVIDIA’s growth is bolstered by its continued innovation in AI technology. The company has recently introduced the NVIDIA Grace Hopper superchip, specifically designed to accelerate AI-based cloud computing and to support large language models and recommendations systems. This advancement enables faster data processing and enhances the capability of handling massive AI applications, making it a pivotal tool in AI-driven sectors. The superchip is anticipated to profoundly impact industries that rely heavily on data analysis and real-time AI processing.

What Are the Security Concerns for NVIDIA as It Expands?

As NVIDIA expands its footprint in AI, especially within autonomous driving and online data centers, security becomes a paramount concern. Cybersecurity experts suggest that with the increasing reliance on AI, there comes an elevated risk of cyber threats targeting AI systems. NVIDIA is addressing these issues by enhancing its security frameworks, including the integration of AI-based security protocols to anticipate and mitigate potential cyber threats. This strategic focus on security aims to reassure stakeholders and maintain trust in its expanding AI-powered solutions.

How Does NVIDIA Compare to Competitors in AI?

When compared to its competitors, NVIDIA stands out due to its comprehensive ecosystem approach, which combines high-performance GPUs with robust software solutions. Competitors like AMD and Intel are also advancing their AI technology; however, NVIDIA distinguishes itself by fostering strategic partnerships and collaborations across industries, such as its work with leading cloud service providers and major automotive companies. This synergistic strategy not only amplifies NVIDIA’s market influence but also ensures its technological offerings remain versatile and ready for diverse applications.

Related Links

For more updates and insights, visit the official NVIDIA website: NVIDIA.

Pros and Cons: What Should Investors Consider?

Pros:

– Leadership in AI: NVIDIA’s leading position in both AI hardware and software provides significant growth opportunities.

– Strategic Partnerships: Collaborations with automotive and tech industries increase revenue potential.

– Innovative Product Pipeline: Continuous development of advanced technology, like the Grace Hopper superchip.

Cons:

– Market Volatility: The tech sector’s inherent volatility can impact stock performance.

– Supply Chain Risks: Ongoing global disruptions in the supply chain could affect production.

– Regulatory Challenges: Potential changes in AI-related regulatory policies could pose operational challenges.

Insights: Navigating the Future

Despite challenges, NVIDIA is well-positioned to capitalize on the AI revolution. Investors should keep an eye on the company’s strategic innovations and its ability to navigate supply chain and regulatory landscapes. With AI anticipated to drive next-generation technology, NVIDIA’s adaptive strategy could lead to substantial long-term gains, offering investors a compelling reason to consider its potential impacts.