Table of Contents

- Executive Summary: Key Findings for 2025–2029

- Market Size, Value, and Forecast (2025–2029)

- Emerging Technologies & Manufacturing Advancements

- Key Application Sectors: Telecom, Automotive, Medical, and IoT

- Regional Analysis: Asia-Pacific, North America, Europe & Beyond

- Competitive Landscape: Leading Manufacturers and New Entrants

- Supply Chain Evolution and Raw Material Trends

- Sustainability Initiatives and Environmental Impact

- Strategic Partnerships, M&A, and Investment Activity

- Future Outlook: Disruptive Trends and Long-Term Opportunities

- Sources & References

Executive Summary: Key Findings for 2025–2029

The quartz crystal oscillator manufacturing sector is poised for steady growth and technological advancement between 2025 and 2029, driven by escalating demand in telecommunications, automotive electronics, industrial automation, and consumer devices. The transition to 5G, the proliferation of IoT devices, and increased automotive electrification are primary catalysts shaping the industry outlook over the next several years.

- Market Expansion and Investment: Leading manufacturers such as NIHON DEMPA KOGYO CO., LTD. and Seiko Epson Corporation are expanding production capacities to meet rising global requirements for high-precision oscillators. TXC Corporation has announced investments in automation and new fabrication lines, aiming to enhance throughput and reduce lead times.

- Technological Evolution: The ongoing shift towards miniaturized, surface-mount quartz oscillators is expected to accelerate. Manufacturers are integrating advanced photolithography and precision cutting techniques to achieve tighter frequency tolerances and improved thermal stability, responding to the needs of 5G base stations and advanced driver-assistance systems (ADAS) in vehicles (Murata Manufacturing Co., Ltd.).

- Supply Chain Localization and Resilience: In response to recent global supply chain disruptions, companies are localizing portions of their supply chains and investing in regional manufacturing hubs. KYOCERA Corporation and TAITIEN Electronics Co., Ltd. have both announced moves to diversify sourcing and broaden their manufacturing footprints to mitigate risks related to geopolitical uncertainties and logistics delays.

- Environmental and Regulatory Compliance: From 2025 onwards, adherence to stricter environmental regulations will be central. Manufacturers are optimizing crystal cutting and cleaning processes to reduce waste and energy consumption (Raltron Electronics Corporation). Implementation of RoHS and REACH directives is anticipated to influence material selection and process adjustments.

- Outlook 2025–2029: The industry is forecasted to experience moderate but sustained growth through 2029, underpinned by increased adoption in automotive, industrial, and telecom infrastructure markets. R&D in ultra-low-jitter and temperature-compensated oscillators will further differentiate leading players. Strategic investments in automation and enhanced quality control will be critical for maintaining competitiveness and meeting the evolving demands of next-generation electronic systems.

Market Size, Value, and Forecast (2025–2029)

The quartz crystal oscillator manufacturing market, a critical segment of the electronic component industry, is projected to demonstrate steady growth from 2025 through 2029. This trajectory is driven by expanding demand across telecommunications, automotive electronics, industrial automation, and consumer electronics. Global manufacturing leaders continue to invest in capacity expansions and technological advancements to address evolving industry requirements for precision, miniaturization, and reliability.

As of 2025, global leaders such as Seiko Epson Corporation, TXC Corporation, and Nihon Dempa Kogyo Co., Ltd. are focusing on high-frequency, low-power crystal oscillators tailored for 5G infrastructure, electric vehicles, IoT devices, and advanced industrial controls. For example, Seiko Epson Corporation has recently enhanced its production capabilities for ultra-miniaturized SMD (surface mount device) crystals, responding to the increasing integration density in smartphones and wearables.

The automotive sector’s rapid electrification and the rollout of advanced driver-assistance systems (ADAS) are fueling higher demand for robust, temperature-stable quartz oscillators. Nihon Dempa Kogyo Co., Ltd. highlights that automotive-grade oscillators are anticipated to be a major growth driver through 2029, particularly with the proliferation of electric vehicles and autonomous driving technologies. Similarly, TXC Corporation is expanding its automotive and industrial product lines, citing growing orders from global OEMs.

On the supply side, the industry is navigating persistent pressures related to raw material sourcing, energy costs, and the need for supply chain resilience. Manufacturers are increasingly adopting automation and digitalization within their fabrication processes to improve yields, reduce lead times, and ensure quality consistency. Seiko Epson Corporation and TXC Corporation both report ongoing investments in smart manufacturing and environmental sustainability, aiming to align with regulatory and customer expectations over the coming years.

Looking ahead to 2029, the market outlook remains positive, with double-digit percentage growth forecasted in specialized segments such as high-frequency oscillators for 5G/6G networks and ultra-low-power variants for IoT and medical devices. Strategic investments in R&D and geographic diversification of manufacturing footprints—especially in Southeast Asia and Eastern Europe—are expected to further enhance global supply chain stability and competitiveness for leading manufacturers.

Emerging Technologies & Manufacturing Advancements

The manufacturing of quartz crystal oscillators is undergoing significant transformation in 2025, driven by advancements in miniaturization, automation, and the integration of Internet of Things (IoT) technologies. Leading manufacturers are investing heavily in automated production lines and smart manufacturing systems to enhance both scale and precision, responding to escalating demand from the automotive, 5G, and consumer electronics sectors.

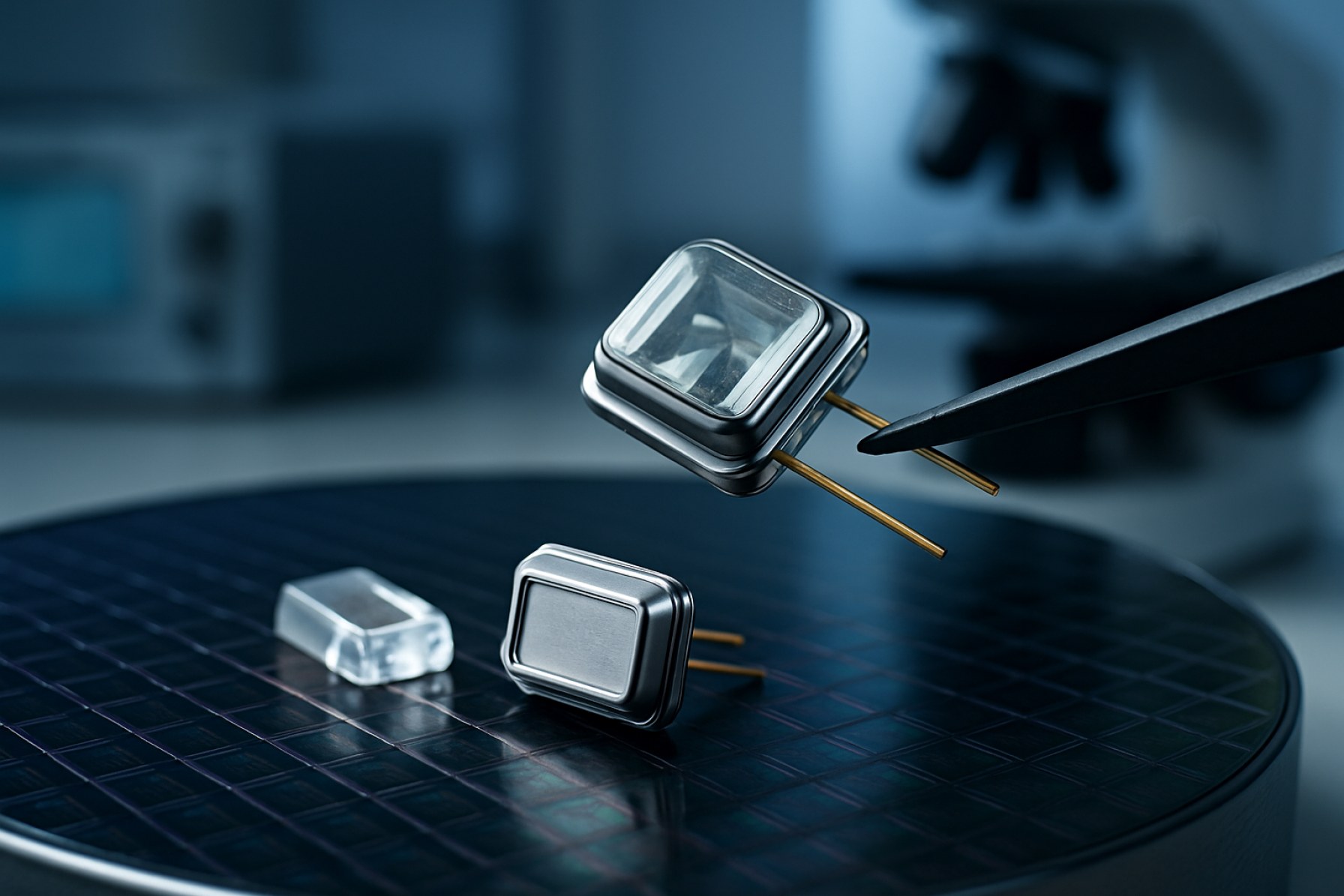

One of the most prominent trends is the evolution of surface-mount device (SMD) quartz crystal oscillators, which offer smaller footprints and improved performance. Companies such as Seiko Epson Corporation and Nihon Dempa Kogyo Co., Ltd. (NDK) have expanded their SMD oscillator portfolios to address the requirements of ultra-compact devices and low-power applications, leveraging advanced photolithography and automation in crystal cutting, mounting, and sealing processes. For instance, Seiko Epson Corporation recently announced the mass production of high-frequency, low-jitter SMD crystal oscillators tailored for 5G and AI infrastructure.

Another key focus in 2025 is the integration of AI-powered quality control and predictive maintenance in manufacturing facilities. Companies like TXC Corporation are deploying machine learning algorithms to monitor equipment performance in real time, reducing defects and improving yield rates for high-precision oscillators. This shift towards smart manufacturing is expected to address challenges such as component miniaturization, tighter frequency tolerances, and the need for rapid scalability in response to market fluctuations.

Material innovation remains central to manufacturing advancements. Efforts to improve quartz wafer purity and develop new packaging materials that enhance thermal stability are underway. Murata Manufacturing Co., Ltd. is pioneering low-profile, high-reliability products designed for automotive and industrial use, utilizing proprietary crystal growth and encapsulation techniques to boost performance in harsh environments.

Looking to the next few years, manufacturers anticipate further advancements in automation, the adoption of Industry 4.0 principles, and increased use of digital twins for process optimization. As the demand for precision timing grows with emerging technologies like edge computing and autonomous vehicles, the quartz crystal oscillator manufacturing sector is poised for continued innovation and robust growth, driven by the efforts of industry leaders and their commitment to technological excellence.

Key Application Sectors: Telecom, Automotive, Medical, and IoT

Quartz crystal oscillators are fundamental timing components that underpin reliability and performance in several key sectors: telecom, automotive, medical, and the rapidly expanding Internet of Things (IoT). As of 2025 and looking ahead, each sector presents distinct requirements and growth trajectories, shaping investment and innovation in quartz crystal oscillator manufacturing.

- Telecom: The global rollout of 5G and preparations for 6G networks are intensifying demand for ultra-stable, low-phase-noise oscillators. Quartz-based solutions remain the preferred choice for precise frequency control in base stations, network infrastructure, and small cell deployments. Industry leaders such as TXC Corporation and Seiko Epson Corporation have expanded their product lines to meet stringent telecom standards, offering temperature-compensated and oven-controlled crystal oscillators (TCXOs and OCXOs) for enhanced stability. The sector is poised for double-digit growth through 2028, driven by continuous network upgrades and densification.

- Automotive: Electrification, advanced driver-assistance systems (ADAS), and infotainment applications are rapidly increasing oscillator content per vehicle. Automotive-grade quartz crystal oscillators must meet rigorous standards for shock, vibration, and temperature performance. Murata Manufacturing Co., Ltd. has scaled up production of AEC-Q200 qualified oscillators, while Nihon Dempa Kogyo Co., Ltd. (NDK) is focusing R&D on miniaturized units for space-constrained electronic control units (ECUs). In the near term, robust supply chains and automotive-specific qualification will remain critical.

- Medical: Reliability and precision are paramount for oscillators in medical imaging, diagnostics, and implantable devices. The regulatory landscape, particularly in the US and EU, mandates strict quality controls. Microchip Technology Inc. and SiTime Corporation continue to introduce high-reliability oscillators tailored for life-supporting and monitoring equipment. As remote and wearable diagnostics proliferate, demand for ultra-miniature, low-power quartz oscillators is set to rise through 2026 and beyond.

- IoT: The IoT sector is experiencing exponential growth, with billions of connected devices anticipated by 2027. Here, quartz crystal oscillators are prized for their cost-effectiveness, low-power consumption, and stability in wireless modules and edge sensors. Abracon LLC and Raltron Electronics Corporation are expanding offerings of surface-mount and ultra-low-power oscillators to cater to the IoT ecosystem. Volume-driven innovation in packaging and integration is expected to dominate manufacturing strategies over the next several years.

Across these application sectors, the outlook for quartz crystal oscillator manufacturing is robust, with continued advances in miniaturization, energy efficiency, and reliability driven by sector-specific requirements and global digitalization trends.

Regional Analysis: Asia-Pacific, North America, Europe & Beyond

The manufacturing landscape for quartz crystal oscillators is marked by dynamic regional trends, with Asia-Pacific, North America, and Europe serving as pivotal centers of production and innovation. As of 2025, Asia-Pacific remains the dominant hub, propelled by its robust electronics and automotive sectors, as well as the presence of leading manufacturers such as Seiko Epson Corporation, Nihon Dempa Kogyo Co., Ltd. (NDK), and Daishinku Corp. (KDS). Japan, in particular, sustains its reputation for high-precision manufacturing and continuous technological refinement in frequency control devices. Meanwhile, China continues to expand its capacity, with domestic players investing in automation and advanced manufacturing processes to reduce reliance on imports and secure supply chains for consumer electronics and telecommunications equipment.

North America is characterized by its integration of quartz oscillator manufacturing with high-value applications in aerospace, defense, and telecommunications. Companies such as TXC Corporation (with significant North American operations) and Microchip Technology Inc. support the region’s focus on reliability and innovation, especially for critical infrastructure and 5G network deployments. A key trend in North America is the strategic reshoring of certain manufacturing operations to mitigate supply chain disruptions, a lesson underscored by recent global events.

In Europe, the market is driven by a strong automotive electronics sector, as well as a growing push for industrial automation and medical devices. Companies like Axtal GmbH & Co. KG and Euroquartz Ltd exemplify the region’s focus on customized, high-reliability oscillator solutions. European manufacturers are also emphasizing compliance with stringent environmental standards and investing in R&D for next-generation frequency products, including temperature-compensated and ultra-low phase noise oscillators.

Beyond these regions, emerging markets in Southeast Asia and India are attracting investments for both component assembly and R&D facilities, aiming to tap into local electronics manufacturing growth. The expansion of the Internet of Things (IoT), 5G, and electric vehicles is expected to drive further regional diversification in quartz oscillator manufacturing through 2025 and into the latter part of the decade.

Looking ahead, the global quartz crystal oscillator manufacturing sector is poised for incremental capacity enhancements, greater automation, and continued regional specialization. As end-user industries demand higher performance and supply chain resilience, manufacturers across Asia-Pacific, North America, and Europe are likely to deepen collaboration and invest in new technologies, ensuring a stable and innovative supply landscape for years to come.

Competitive Landscape: Leading Manufacturers and New Entrants

The competitive landscape of quartz crystal oscillator manufacturing in 2025 is shaped by a mix of long-established industry leaders and a wave of innovative new entrants. The sector is characterized by ongoing advancements in miniaturization, frequency stability, and integration with semiconductor technologies, driven by expanding applications in telecommunications, automotive electronics, IoT, and 5G infrastructure.

- Established Leaders: Industry incumbents such as Seiko Epson Corporation, NIHON DEMPA KOGYO CO., LTD. (NDK), TXC Corporation, and KYOCERA Crystal Device Corporation continue to dominate the global market. These companies leverage decades of expertise, comprehensive product portfolios, and robust global supply chains to serve high-volume demands for consumer electronics, automotive, and industrial applications.

- Technological Innovation: Leaders are investing heavily in R&D to push the boundaries of performance, focusing on ultra-miniaturized SMD packages, higher frequency precision, and enhanced temperature stability. For example, Seiko Epson Corporation has recently expanded its range of high-frequency, low-jitter oscillators tailored for next-generation networking and data center applications.

- Regional Expansion and Localization: With the ongoing semiconductor supply chain realignment, manufacturers are increasing investments in regional production facilities. NIHON DEMPA KOGYO CO., LTD. has announced new capacity expansions in Asia to meet surging demand for automotive-grade oscillators, while TXC Corporation is strengthening its presence in Europe and North America.

- Emerging Players and Niche Innovators: New entrants, particularly in China and Southeast Asia, are gaining traction by leveraging cost-efficient manufacturing and targeting niche sectors such as wearables, MEMS-integrated oscillators, and high-reliability medical electronics. Companies like Fujitsu Components Limited are introducing novel hybrid oscillators that blend quartz and MEMS technology for improved resilience and size reduction.

- Outlook: The next few years are expected to see heightened competition as demand for precision timing devices grows with 5G, autonomous vehicles, and industrial automation. Leading manufacturers are likely to retain core market share through ongoing innovation and strategic alliances, but agile new entrants will continue to disrupt established supply chains, particularly in fast-growing application segments.

Supply Chain Evolution and Raw Material Trends

The supply chain for quartz crystal oscillator manufacturing is undergoing notable transformation in 2025, shaped by evolving raw material sourcing strategies, regional diversification, and technological advancements. As quartz remains the cornerstone material for oscillator production, its procurement, processing, and purity are central concerns for manufacturers. Major industry players like Seiko Epson Corporation and Nihon Dempa Kogyo Co., Ltd. (NDK) continue to invest in vertically integrated supply chains, aiming to secure high-quality quartz and mitigate risks associated with geopolitical tensions and logistic disruptions.

Natural quartz is primarily sourced from Brazil, Madagascar, and the United States. However, the industry is increasingly shifting towards the use of synthetic quartz, cultivated under controlled conditions to achieve higher purity and uniformity. Companies such as TXC Corporation and ECS Inc. International are expanding their synthetic quartz production capacities to reduce dependency on natural sources, thereby enhancing supply chain resilience and environmental sustainability.

Recent years have seen a rise in collaborative efforts between manufacturers and raw material suppliers to ensure traceability and ethical sourcing of quartz. For example, Micro Crystal AG emphasizes responsible sourcing and close partnership with its quartz suppliers to maintain consistent material quality and meet global regulatory standards. This approach is expected to gain further traction in 2025 as consumer electronics, automotive, and industrial sectors demand greater transparency and reliability.

Technological advancements in quartz cutting, lapping, and frequency adjustment processes are also influencing supply chain dynamics. Automation and digitalization in these areas, as implemented by Daishinku Corp. (KDS), are reducing production cycle times and improving yield rates, which is crucial given the increasing demand for miniaturized and high-frequency oscillators in next-generation applications.

Looking ahead to the next few years, the outlook for quartz crystal oscillator supply chains includes a continued focus on synthetic quartz expansion, increased regional diversification to mitigate geopolitical risks, and further integration of environmentally responsible practices. As the global electronics market continues to grow, manufacturers will likely prioritize supply security, quality assurance, and sustainable raw material management to stay competitive and compliant with international standards.

Sustainability Initiatives and Environmental Impact

The quartz crystal oscillator manufacturing industry has significantly increased its focus on sustainability and environmental stewardship as it enters 2025. Given the energy-intensive nature of crystal growth, precision cutting, and microelectronic assembly, leading manufacturers have invested in eco-friendly processes and responsible sourcing to mitigate environmental impact.

Key players in the sector, such as Seiko Holdings Corporation and TXC Corporation, have published comprehensive environmental policies and annual reporting on their energy efficiency initiatives. For instance, Seiko has committed to reducing CO2 emissions by optimizing production lines and increasing the use of renewable energy at its facilities. The company’s ongoing programs include waste reduction, water recycling, and the minimization of hazardous substances in both product and process.

In terms of materials, the industry is moving toward more responsible sourcing of high-purity quartz, a crucial raw material. Epson, a major oscillator manufacturer, has implemented traceable supply chain practices to ensure that quartz is sourced from environmentally responsible mines and that suppliers adhere to ethical labor and environmental standards.

Waste management is another area of focus. Manufacturers like Nihon Dempa Kogyo Co., Ltd. (NDK) have introduced closed-loop recycling systems for process water and implemented advanced filtration to reduce the discharge of chemical residues. NDK also emphasizes the reduction of single-use plastics in packaging and is piloting biodegradable materials for product shipment.

Looking ahead, the industry is expected to further integrate lifecycle assessment tools and eco-design principles. The adoption of ISO 14001-certified environmental management systems is becoming standard among top-tier firms, as regulatory pressure increases in key markets. Furthermore, the push for miniaturization and more energy-efficient oscillator chips, driven by the growth of IoT and mobile applications, is expected to reduce the overall material and energy footprint per device. Collaborative efforts, such as industry-wide consortia for sharing best practices and new recycling technologies, are likely to accelerate progress through 2025 and beyond.

As sustainability becomes an increasingly important differentiator in the electronics supply chain, manufacturers of quartz crystal oscillators are positioning themselves to meet evolving environmental standards and the expectations of global customers.

Strategic Partnerships, M&A, and Investment Activity

The quartz crystal oscillator manufacturing sector continues to witness dynamic activity in strategic partnerships, mergers and acquisitions (M&A), and targeted investments as of 2025. Industry leaders are pursuing collaborations to strengthen global supply chains, accelerate innovation, and capture rising demand for high-performance oscillators driven by 5G, automotive electronics, and IoT applications.

In early 2025, Seiko Solutions Inc. announced an expansion of its longstanding partnership with Epson Electronics. The collaboration aims to co-develop advanced ultra-miniature SMD crystal oscillators optimized for wearable and medical device markets. This joint effort leverages Seiko’s fabrication expertise and Epson’s MEMS technology to achieve higher frequency stability in compact formats.

Meanwhile, TXC Corporation continues to invest heavily in automation and smart manufacturing at its Taiwan and China facilities. In their 2025 corporate update, TXC cited ongoing investments to expand production capacity and integrate AI-powered quality control, enhancing throughput and reducing cycle times for automotive-grade quartz oscillators.

M&A activity is also significant. In late 2024, Nihon Dempa Kogyo Co., Ltd. (NDK) completed the acquisition of a controlling stake in a Southeast Asian crystal blank supplier, securing raw material access and mitigating supply chain risk. This strategic move is expected to stabilize NDK’s oscillator output, particularly for emerging markets in Asia-Pacific.

In Europe, Rakon and Rubicon Crystals announced a strategic alliance in January 2025 to co-invest in R&D focused on low-phase-noise oscillators for satellite communications and defense. This partnership combines Rakon’s expertise in frequency control with Rubicon’s advanced synthetic quartz technology.

Looking ahead, the sector anticipates continued consolidation and cross-border collaborations as manufacturers seek to address ongoing challenges such as raw material supply volatility and evolving device specifications. Companies are expected to prioritize investments in digitalization, supply chain resilience, and vertical integration to sustain competitiveness through 2025 and beyond.

- Seiko Solutions Inc.

- Epson Electronics

- TXC Corporation

- Nihon Dempa Kogyo Co., Ltd. (NDK)

- Rakon

- Rubicon Crystals

Future Outlook: Disruptive Trends and Long-Term Opportunities

The quartz crystal oscillator manufacturing sector is positioned at a transformative juncture, propelled by technological innovation, shifting global supply chains, and evolving end-market requirements. As of 2025, several disruptive trends are shaping the industry’s trajectory for the coming years.

- Miniaturization and Integration: The relentless drive towards smaller, more integrated electronics—especially for wearables, IoT, automotive ADAS, and 5G infrastructure—is spurring demand for ultra-compact SMD (Surface Mount Device) quartz oscillators. Key manufacturers such as Murata Manufacturing Co., Ltd. and Seiko Epson Corporation continue to invest in advanced packaging, MEMS-hybrid solutions, and automation to deliver higher precision and reliability in progressively smaller footprints.

- Automotive and Industrial Expansion: The electrification of vehicles and the proliferation of advanced driver-assistance systems (ADAS) have significantly elevated the quality and reliability standards for oscillators. TXC Corporation and Nihon Dempa Kogyo Co., Ltd. (NDK) are expanding their automotive-qualified product ranges, focusing on high-temperature and high-stability quartz devices to meet stringent AEC-Q200 standards.

- Supply Chain and Localization: The COVID-19 pandemic and subsequent geopolitical shifts have exposed vulnerabilities in the global supply chain for electronic components. In response, manufacturers such as Microchip Technology Inc. are localizing production and building redundancy into their supply networks, aiming to ensure continuity and resilience for critical industries.

- Material Science and Next-Gen Processes: Research into synthetic quartz growth, wafer processing, and low-noise circuit design is yielding incremental gains in oscillator performance. Kyocera Crystal Device Corporation and Taitien Electronics Co., Ltd. are investing in proprietary material processes and automation to reduce power consumption and improve frequency stability.

Looking ahead, the sector’s long-term prospects hinge on its ability to support next-generation connectivity (6G), edge computing, and autonomous systems with ultra-reliable, low-jitter timing. Strategic partnerships, R&D investment, and the adoption of environmentally responsible manufacturing will be essential. With the expansion of smart infrastructure globally, quartz crystal oscillator manufacturers that adapt swiftly to these disruptive trends will be well-positioned for sustainable growth and technological leadership.

Sources & References

- NIHON DEMPA KOGYO CO., LTD.

- Seiko Epson Corporation

- TXC Corporation

- Murata Manufacturing Co., Ltd.

- TAITIEN Electronics Co., Ltd.

- Raltron Electronics Corporation

- Seiko Epson Corporation

- TXC Corporation

- SiTime Corporation

- Daishinku Corp. (KDS)

- Axtal GmbH & Co. KG

- Euroquartz Ltd

- Fujitsu Components Limited

- Seiko Holdings Corporation

- Seiko Solutions Inc.

- Epson Electronics

- Rakon

- Rubicon Crystals