Smallsat Launch Services Market Poised for Exponential Growth and Innovation

Propelling the Next Era: Unleashing the Potential of Smallsat Launch Services Market Overview Emerging Technology Trends Competitive Landscape and Key Players Growth Forecasts and Market Projections Regional Market Analysis Future…

Navigating Ethical AI: Key Challenges, Stakeholder Roles, Case Studies, and Global Governance Insights

Ethical AI Unveiled: Exploring Challenges, Stakeholder Dynamics, Case Studies, and the Path to Global Governance Ethical AI Market Landscape and Key Drivers Emerging Technologies Shaping Ethical AI Competitive Dynamics and…

Fashion Shakes Up Climate Action: How Women & Energy Are Changing the Game in 2025

In 2025, the worlds of fashion, energy, and female leadership collide, propelling global climate action to bold new heights.

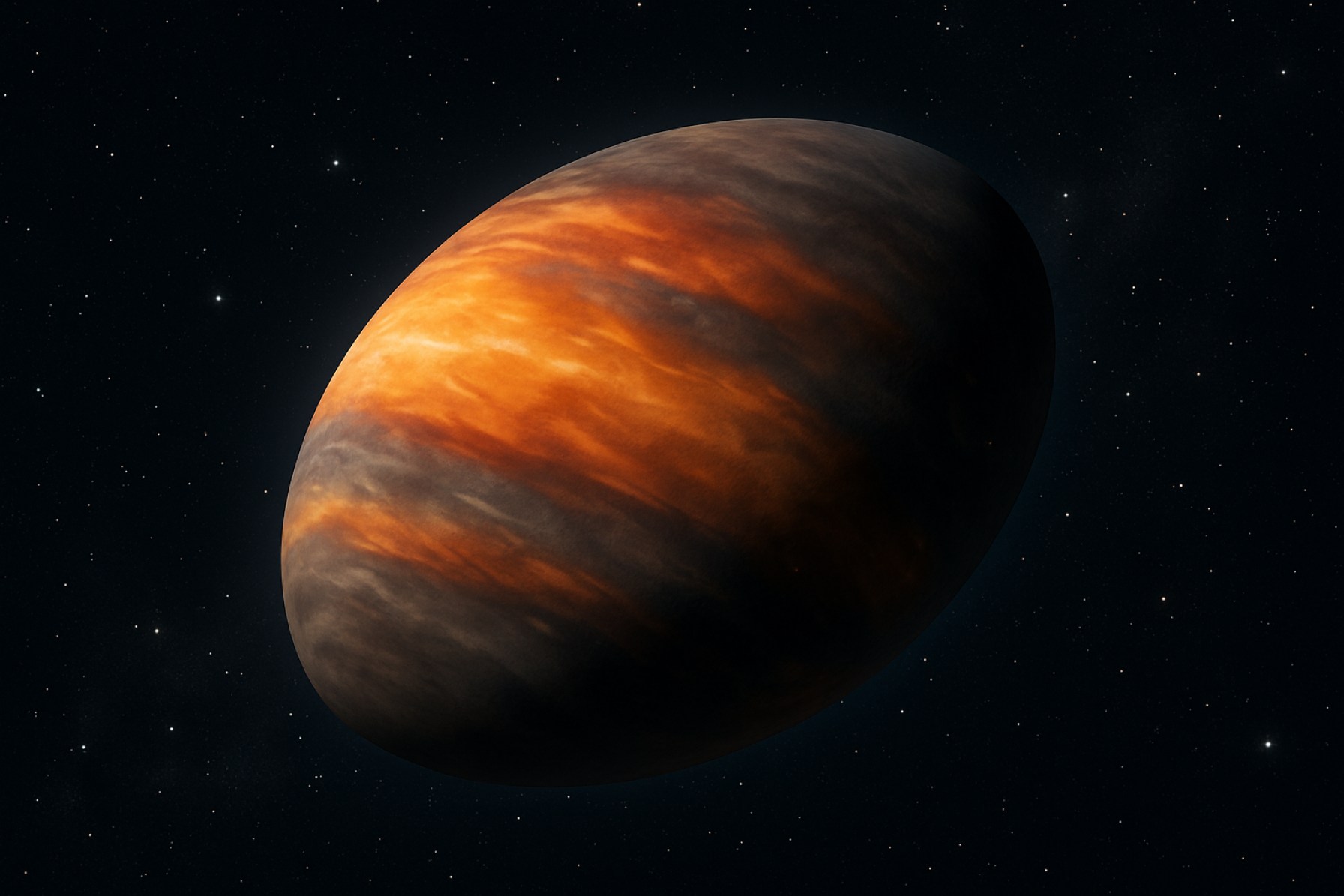

Alien Football-Shaped Planet Baffles NASA: JWST Spots Rare Molecules and Wild Weather 900 Light-Years Away

NASA’s James Webb Space Telescope uncovers rare molecules and wild atmospheric shifts on exoplanet WASP-121b, shaking up planetary science.

NASA’s Galaxy Formation Theories Shattered: James Webb Uncovers Universe’s Chaotic Past

The James Webb Space Telescope upends decades-old ideas about galaxy evolution, revealing a chaotic, dynamic universe with never-before-seen detail.

Nvidia Crushes GPU Competition: New Data Shows AMD and Intel Are Barely Hanging On

Nvidia rockets to a staggering 92% GPU market share in 2025, crushing AMD and Intel’s hopes. Can anyone challenge Team Green’s reign?

Stellar Lumens (XLM) Set to Make Waves in 2025: Is a Major Price Breakout on the Horizon?

Stellar Lumens (XLM) is gaining momentum in 2025. Analysts predict a breakthrough year—find out if XLM is poised for explosive growth.

$150 Billion Switch: How Tech and Renewables Are Revolutionizing Eastern Europe’s Power Future

Inside the Radical Digital Drive Set to Slash Emissions and Costs Across Eastern Europe’s Ageing Energy Grid UNECE forecasts show that bold digital moves could cut emissions by 70% and…

Wall Street Shocker: Why Investors Are Racing to Join Motley Fool in 2025

Is Motley Fool Membership the Secret Weapon Every 2025 Investor Needs? Discover why Wall Street insiders and everyday investors are flocking to Motley Fool for top stock picks and premium…

Additive Hybrid Manufacturing Market 2025: 18% CAGR Driven by Advanced Automation & Material Innovation

Additive Hybrid Manufacturing Industry Report 2025: Market Size, Technology Trends, and Strategic Growth Insights. Explore Key Drivers, Regional Leaders, and Future Opportunities in Hybrid Manufacturing. Executive Summary & Market Overview…